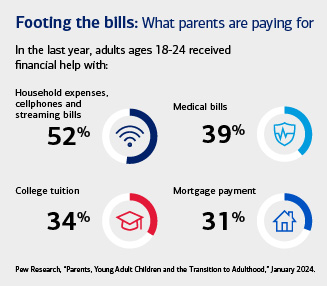

1 Pew Research, “Parents, Young Adult Children and the Transition to Adulthood,” January 2024.

2 IRS.gov, May 2024.

Investing involves risk. There is always the potential of losing money when you invest in securities.

Merrill, its affiliates, and financial advisors do not provide legal, tax, or accounting advice. You should consult your legal and/or tax advisors before making any financial decisions.

This material should be regarded as educational information on Social Security and is not intended to provide specific advice. If you have questions regarding your particular situation, you should contact the Social Security Administration and/or your legal advisors.

The Chief Investment Office (CIO) provides thought leadership on wealth management, investment strategy and global markets; portfolio management solutions; due diligence; and solutions oversight and data analytics. CIO viewpoints are developed for Bank of America Private Bank, a division of Bank of America, N.A., (“Bank of America”) and Merrill Lynch, Pierce, Fenner & Smith Incorporated (“MLPF&S” or “Merrill”), a registered broker-dealer, registered investment adviser and a wholly owned subsidiary of Bank of America Corporation (“BofA Corp.”).

Investments have varying degrees of risk. Some of the risks involved with equity securities include the possibility that the value of the stocks may fluctuate in response to events specific to the companies or markets, as well as economic, political or social events in the U.S. or abroad. Bonds are subject to interest rate, inflation and credit risks.